Reasons To Invest

The drastic supply shortage & the rapid increase in demand makes Pink Diamonds from the Argyle Mine a well-regarded investment with strong annual returns over 90% Global Supply Cut*

In 2020, the closure of the Argyle Diamond Mine by Rio Tinto meant the global supply of pinks has be reduced by over 90%.

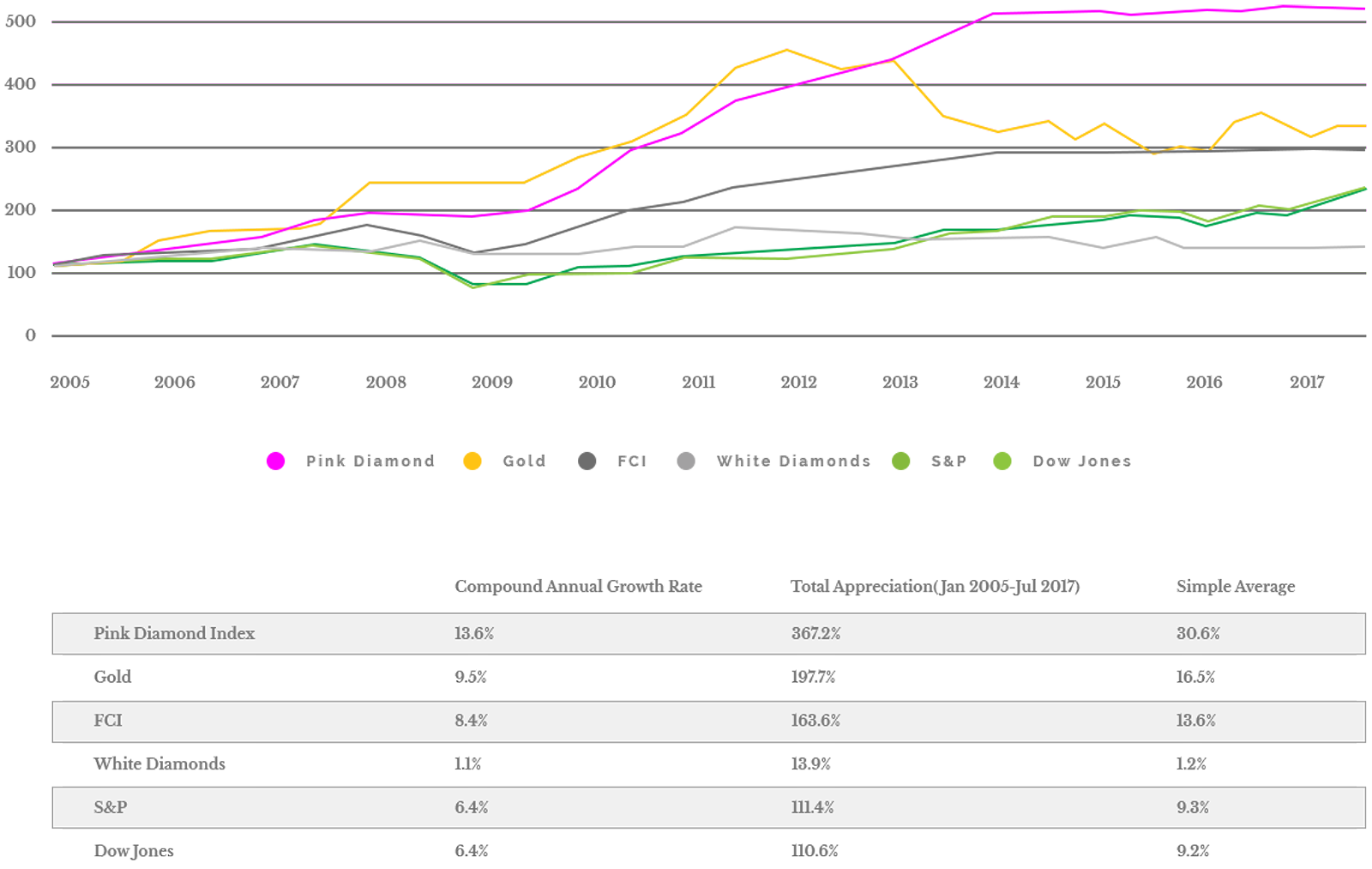

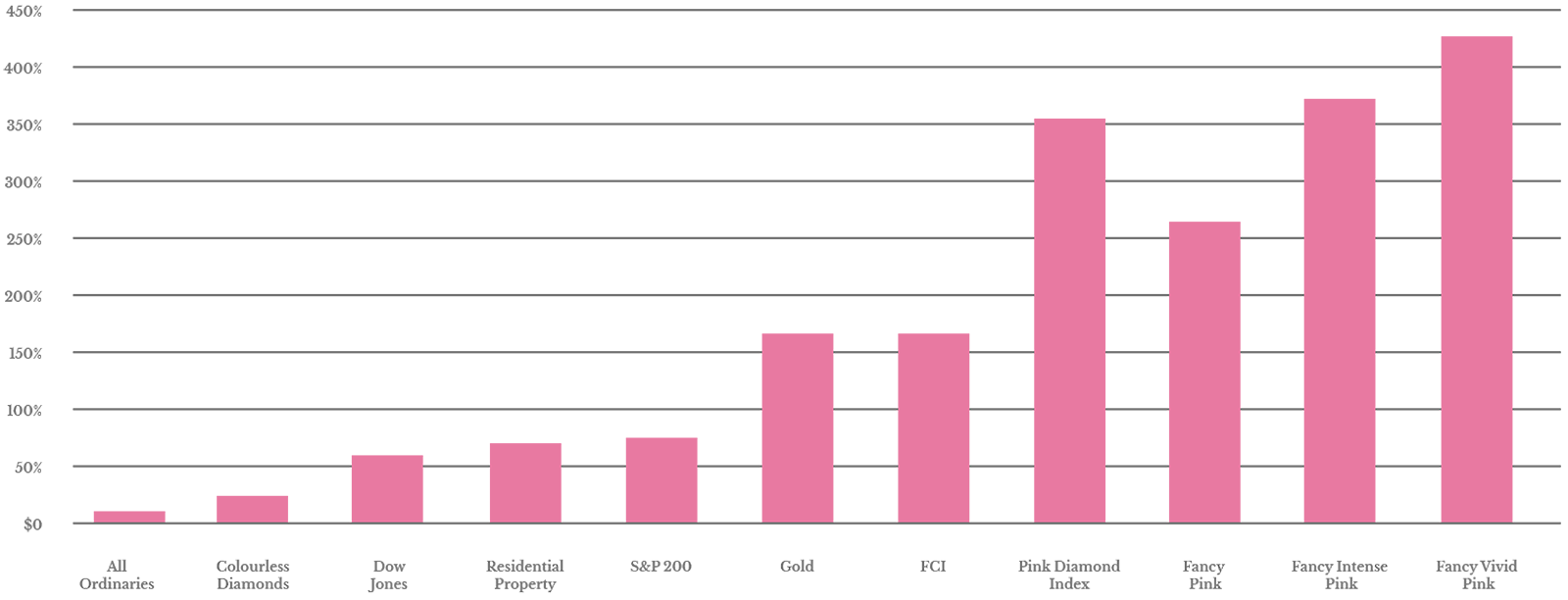

Pink Diamond Performance Chart

13.8%Average Growth Per Year*

Price Waterhouse Cooper believes that in the last 2 years with the increase in price of the Pink Diamonds it has become the fastest growing hard asset in the world.

Additionally given that there are no new mining sources that could contribute to supply, the demand-supply gap will widen in the medium to long term. This will result in a continued increase in the price of Pink Diamonds from the Argyle Mine over this period. Investing in Pink Diamonds is proving to be one of the best performing assets available to investors, with growth far exceeding that of gold and property investments.